Guided Investment

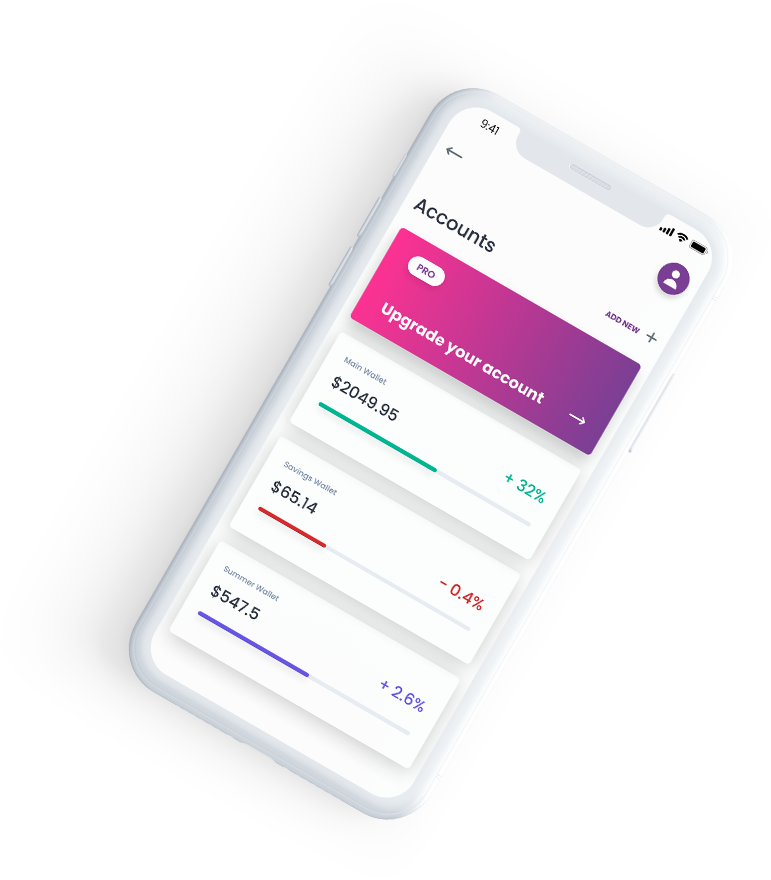

Our services encompass expert investment guidance, portfolio analysis, risk assessment, and strategic planning, empowering clients to make informed decisions and achieve financial prosperity.

Our services encompass expert investment guidance, portfolio analysis, risk assessment, and strategic planning, empowering clients to make informed decisions and achieve financial prosperity.

We are Sub broker of Leading broking Company, provides the demat and trading accounts. We help people to create wealth in stock market & provide FD, IPO, Right issues etc services.

a comprehensive assessment of an individual's or entity's financial situation and goals to develop a structured strategy that aims to achieve specific financial objectives.

Providing expertise on property investments, market dynamics, and effective property management strategies for optimal outcomes and financial growth.

Identifying and assessing risks associated with investments, developing strategies to mitigate risks and protect assets.

Providing in-depth market research, analysis, and forecasts to guide investment decisions and property acquisitions.

Providing strategies for managing and restructuring debt to achieve financial stability and long-term financial health.

Retirement planning is a strategic process that involves setting financial goals and creating a roadmap to achieve a secure and comfortable retirement. It's about determining how much money you'll need for retirement and developing a plan to meet those financial goals. Here's a more detailed overview of retirement planning:

Assessing Current Financial Situation:

Evaluate your current financial status, including assets, liabilities, income, expenses, and investments.

Determining Retirement Goals:

Define your retirement goals and lifestyle expectations, including estimated retirement age, desired retirement income, travel plans, housing preferences, and healthcare considerations.

Estimating Retirement Expenses:

Calculate expected retirement expenses, including housing, healthcare, living costs, travel, hobbies, and any other planned activities.

Evaluating Retirement Income Sources:

Assess potential sources of retirement income, such as pensions, investments, annuities, part-time work, or other sources.

Savings and Investment Strategy:

Develop a savings and investment strategy to accumulate the necessary funds for retirement. This may include contributions to retirement accounts like PF, EPF, PPF, NPS, etc.

Tax-Efficient Retirement Planning:

Optimize contributions to tax-advantaged retirement accounts to minimize tax liability both now and during retirement.

Healthcare Planning:

Consider healthcare costs during retirement and plan for health insurance, long-term care insurance, and potential medical expenses.

Risk Management:

Evaluate insurance needs, including life insurance, disability insurance, and long-term health insurance, to mitigate financial risks during retirement.

Inflation and Cost of Living Considerations:

Account for inflation and potential increases in the cost of living when projecting retirement income needs.